Top of my list of goals for next year (or which there are many because I have lost time to make up for) is to FINALLY pass my driving test. After seven attempts spread over almost 12 years I am determined that I only have to sit one more. The truth is I CAN drive, and drive well. The reality is that as soon as I’m in a test scenario my anxiety goes in to overdrive and gets the better of me, I’ve tried every suggestion under the sun to combat it and it hasn’t worked- on my last test I actually didn’t make it out of the car park!

Anyway, I digress. With passing my test will come the excitement of FINALLY buying a car. I don’t know much about the world of cars but what I have learnt from being chauffeured around by friends and family is that they cost a lot more than first meets the eye. It’s easy to overlook certain costs, things you don’t necessarily think about when caught up in the excitement of test drives and purchases. I’ve been playing around with the car finance calculator and motoring cost calculator from the folks at Motorparks.

The car finance calculator is there to help once you know what car it is you want to purchase…it takes interest rates, loan terms and deposit in to account and tells you what your monthly payment will be and how much you’ll pay for the car in total (don’t forget the interest adds up!)

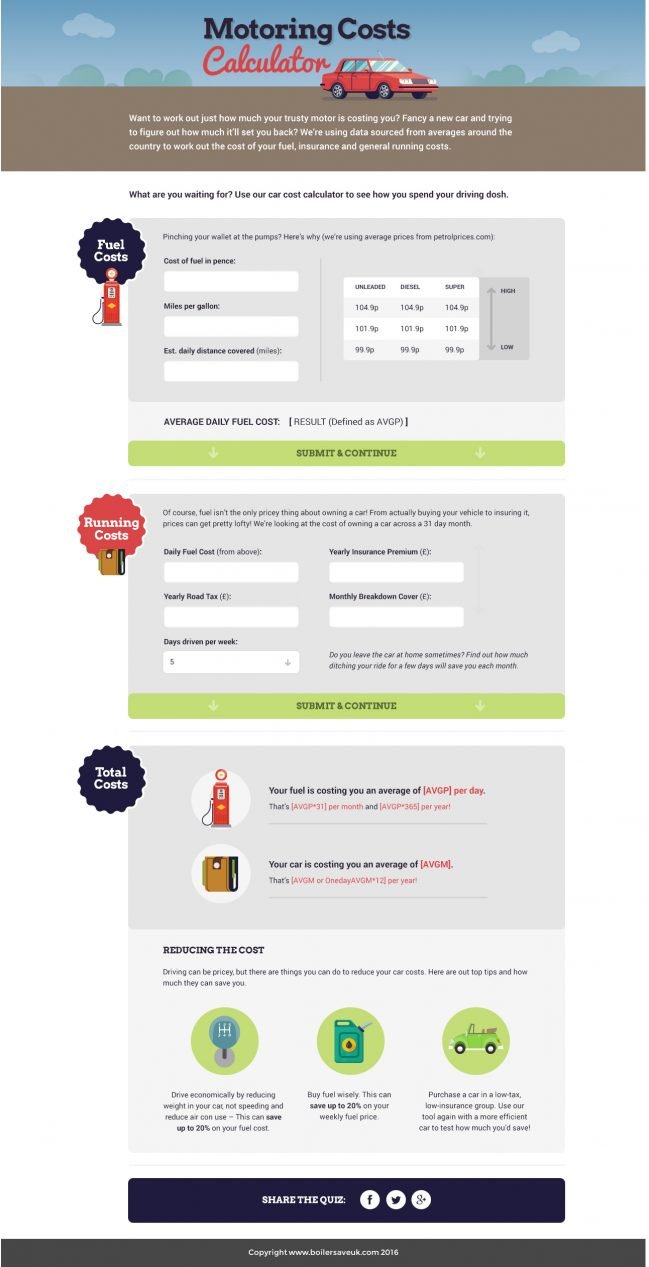

The motoring cost calculator will walk you through how much your fuel is costing you per day. This was a real eye opener when Ben started driving as his mini guzzled fuel and he ended up trading in for a more economical vehicle after a while with dramatic savings.

The calculator will also help you keep tabs on general motoring costs- road tax, insurance, breakdown cover etc to show you how much your car is actually costing you per month. There are also plenty of tips and advice on how to get those costs down.

What costs surprised you most when you first started driving? Any tips for driving test nerves?

![]()